The simple and quick answer is – Yes.

Depending on the purpose you are buying for, there are 2 main options available for Malaysians. We always ask buyers whether they are buying for investment or own use, as this may affect how they may choose to finance the purchase, if they do not have the full 100% funds available to complete, at the time that is required to complete.

Staged out deposit payments for off-plan properties

Off-plan purchase is the most popular option to purchase as there is construction or waiting time for Malaysian buyers to save up deposits or make staged downpayment across a number of years, providing better cash flow and increase affordability. Whilst it is common to only pay between 10% – 30% deposit across a period of 12 – 18 months (with no interest payable in between the construction period), this allows Malaysian buyers time to convert their MYR to GBP as and when they find the exchange rate is favourable to them.

Why UK bank mortgage?

Malaysians have an option to acquire mortgage from Malaysian banks or UK banks, now why would one choose UK bank if Malaysian banks can finance? These are some of the key reasons why Malaysians would opt for a UK loan instead from Malaysian banks:

● Buying purely for investment and would prefer Buy-To-Let loan where it’s an interest-only facility

● Children are working in the UK, they get to acquire UK home loan mortgages

● Parents making the purchase have reached the age limit of 70 years, some UK Buy-to-let loans have age limits that extends to the age of 85 years

● UK banks can finance properties anywhere in the UK, where Malaysian banks are limited to certain zones and/or areas

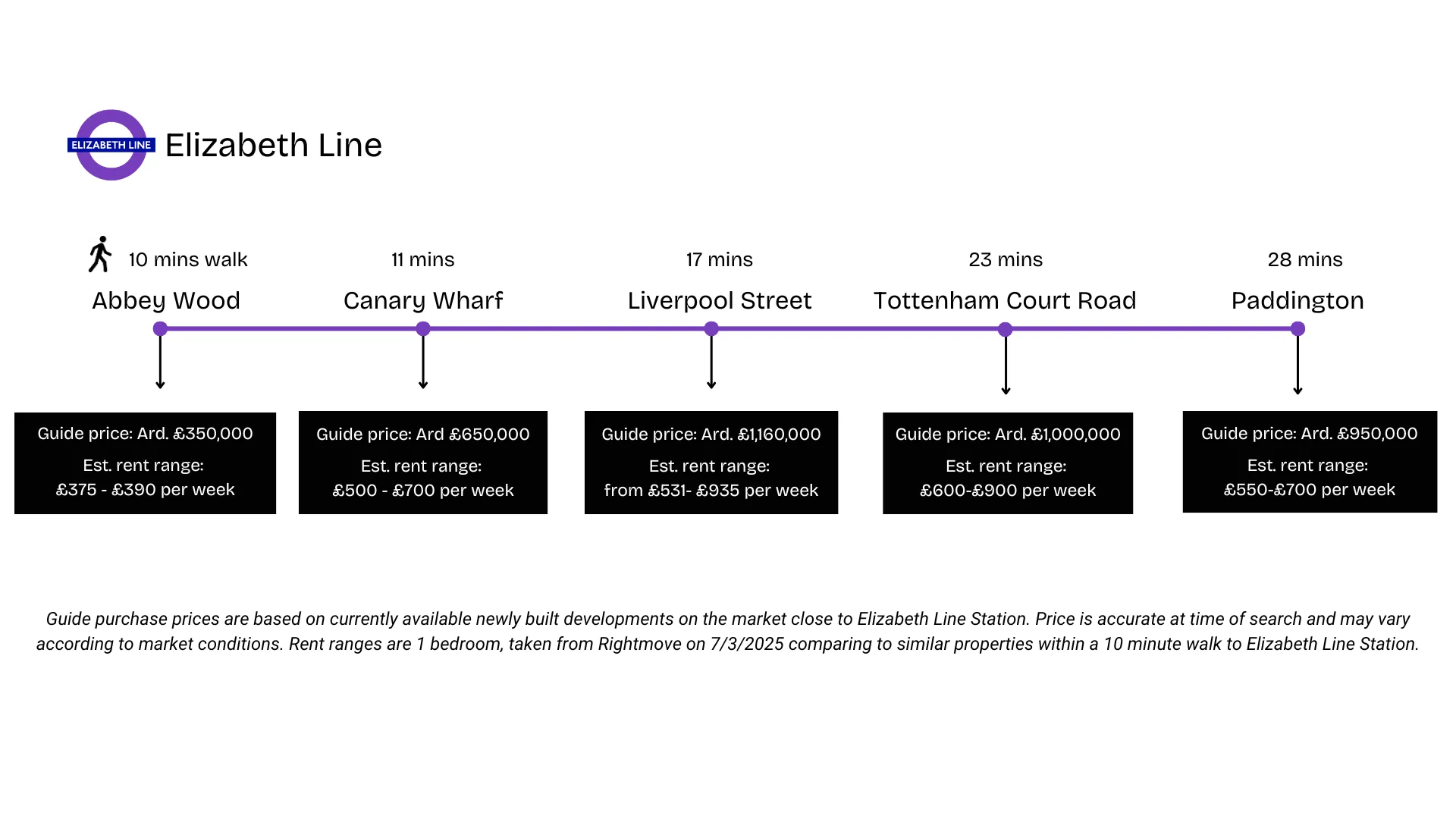

● Looking to achieve higher Loan-To-Value, if you are investing, UK banks would consider the rental income that can be achieved to process your loan application, this may give you an edge to get a higher LTV subject to your income documents

How do you know if you qualify for a UK mortgage?

First and foremost is contact us to find out what are your options, as mentioned in the beginning the purpose of making the purchase affects the decision when it comes to where the funds will come from to complete on the property, and how you prefer to finance it. For cross border purchases, buyers have to also consider the exchange rates to see if it will benefit your long-term investment goals. If you don’t know where to start, we could guide you based on the different stages or needs you are at:

● Don’t have a property yet, but want to know the maximum price you could afford

● You have spoken to some Malaysian banks but they have declined your application, you’d now want to explore options from UK lenders

● You bought a property outside of where Malaysian banks could finance

● Your child is a UK resident, working & living in the UK but may not have sufficient working years to qualify for a normal UK home loan and want to explore UK Expat mortgage options

What documents do I need to prepare?

It is quite similar to applying for a Malaysian home loan, however, with Buy-to-let investors the property yield performance adds-up to the consideration when mortgage brokers prepare the loan package, after being able to review the documents and buyer profile:

● Income documents for employed persons: 3 – 6 months payslip and/or other incomes that can boost one’s income profile

● Other repayments: Housing loans, car loans, instalment payments in Malaysia, number of dependents (if any)

● Income documents for employer: Salary that is paid to yourself and business revenue, such as certified accounts with 3 years tax returns, certificate of incorporation and others subject to the mortgage broker’s advisory

● Benham & Reeves are able to provide rental estimate on your London property to assist with your UK BTL loan application, UK lenders can consider future income that will be generated from the property during your application

Expat and foreign national mortgages

UK loans given to foreign nationals who invests/purchase in the UK are subject to special provisions that can differ from one nationality to another. Usually, lending to foreign nationals is more investor-led, with BTL mortgages (interest-only) options more commonly provided by UK lenders. However, with many Malaysians continue to work & live in the UK, it is also not uncommon to get a UK mortgage to purchase a home to live-in. While interest rate varies on the type of mortgage and differ between lenders, the maximum term you can expect for repayment is up to 35 years or up to the age of 85, whichever comes first. Also, while there is no cap on the maximum amount that can be borrowed, a good benchmark to estimate the maximum mortgage that you can get is approximately 4.5 times your annual salary.

While factors such as your income, property value, and deposit will determine whether you qualify for a mortgage in the UK, consulting with an expert mortgage advisor and using tools such as our mortgage calculator is always recommended before you apply for a mortgage.

Disclaimer: Information on UK mortgage loan is deemed accurate at time of publish and may subject to change depending on lenders/lending criteria. Please contact branch for verification should you wish to find out more about the information published herein.